Blog Posts

Unveiling the mystery of brand tracking: The top questions answered by trackers

May 10, 2023

To kick off our series on the ins and outs of brand tracking we are starting with the basics. More specifically, the types of business questions a brand tracker can answer. In our perspective here at Nepa, brand tracking is an essential business tool to make informed business decisions. Unfortunately, many companies tend to underuse their brand trackers. It’s often primarily used to measure KPIs for internal reports, with results only looked at every month or quarter. However, to stay ahead as a brand in an ever-evolving world, it is crucial to continuously measure, analyse and adapt your business strategies. Here is where really making the most of your tracker comes into play.

Tips to increase the value of your brand tracker: Check your measurements

A well-designed tracker can answer a broad set of business questions. These go beyond the basics of simply following some sort of brand funnel or key management KPIs such as consideration, preference, and purchase/usage perspectives. Some of the typical questions that a Nepa brand tracker can answer include:

Brand awareness: To what degree are people aware of your brand, and are your marketing efforts paying off?

Brand and competitor perception: How do people perceive your brand and your competitors? Are you seen as trustworthy or untrustworthy, innovative or old-fashioned? How do you compare to your competition?

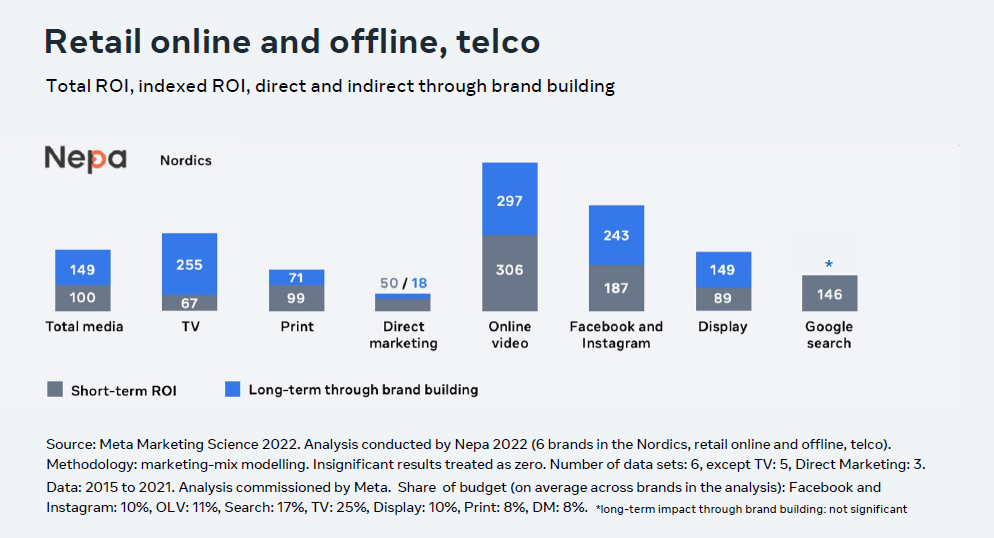

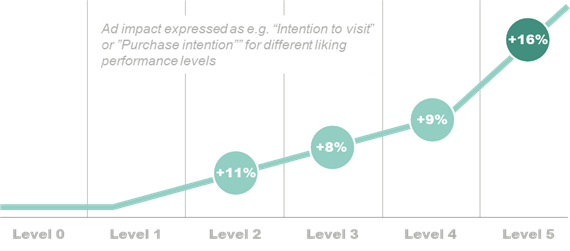

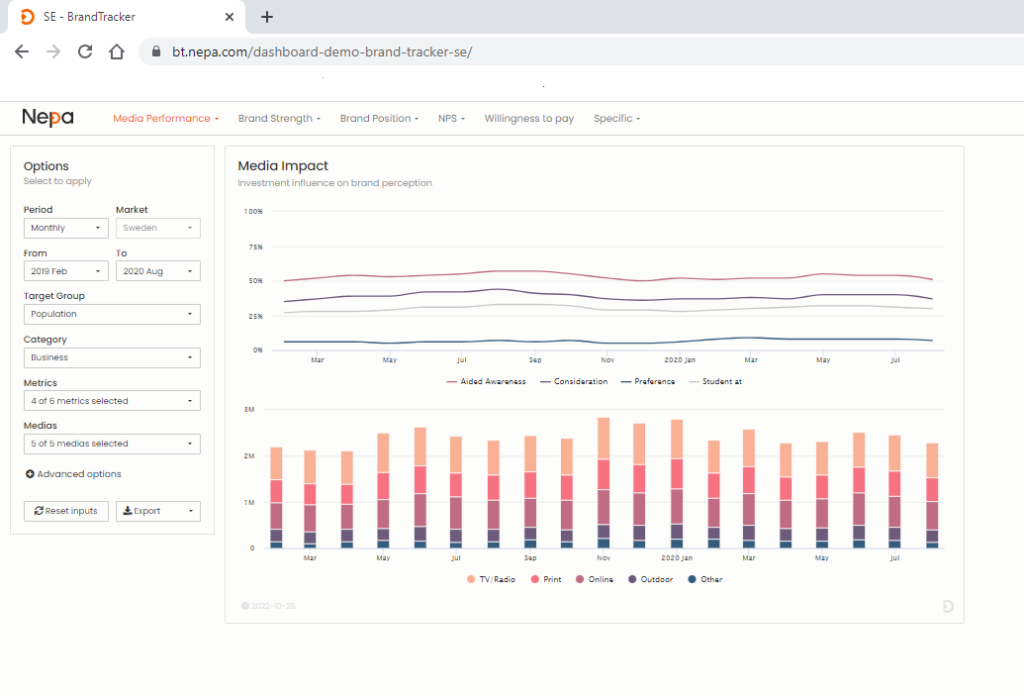

Marketing impact: Are your marketing campaigns resonating with your target audience, and do they have a lasting effect? What actions should you take to optimise your marketing strategy?

Market drivers: Is your brand truly answering the needs and expectations of the market that are the true drivers of consideration or sales? Do you differentiate yourself on these factors when compared to your competition?

Customer loyalty: Are your customers more loyal to you or your competitors? What drives customer loyalty, and how can you improve customer retention?

Target audience: Who are the consumer groups that are most attracted to and purchase your brand, and how do they relate to the competing offerings out there?

Tips to increase the value of your brand tracker: Focus on core business questions

If you want to elevate your brand tracking and make it an even stronger business tool, there are some additional things to consider in choosing both set-up and supplier:

1. The set of attributes that you include in your tracking is crucial to define how your brand, and competing brands, is seen by your consumers. If the attributes measured are not truly comprehensive, it will give you the wrong picture of your brand’s position, increasing the risk of making wrong business decisions.

2. A continuous brand tracker is far more useful as a business tool than those performed periodically in dips quarterly, or even annually. With a continuous tracker, you get several advantages that are crucial in a world where constantly changing demands is the only thing you can be sure of. In addition, this approach creates a granular time-series of data that can be connected to other continuous data sources, such as sales, visits, etc. This then offers completely new arena of analytical possibilities using predictive modelling and econometrics.

3. Often when setting up a brand tracker a lot of focus, and rightly so, is on getting your competitor list right and deciding on which brand associations to include. Less time is spent on background questions, which offer the possibility to add further dimensions such as target groups or situational perspectives. What you miss if these questions are not relevant to your category and carefully considered is the possibility to take the analysis, and thus the value of the insights, to the next level.

4. The possibility to calculate the value or equity of your brand is something that some brand trackers claim to be able to do, but are they really? It is essential to use a tracking module that truly delivers on the need to understand brand value. We at Nepa pride ourselves with our Willingness to Pay module that truly delivers. It is based on cutting-edge conjoint methodology that has been adapted work alongside continuous brand tracking, offering you insights into the true value the market is applying to your brand compared to competing brands. It means no more guesswork, no strange index solutions that are hard to explain internally, just a simple figure measured in your own currencies.

5. Your supplier should be an expert at analysing tracking data. Challenge them, and if you do not get even more value from the data that you are already collecting, simply change the supplier. Don’t get caught up in a sunk coast fallacy.

In conclusion, brand tracking is an always-on measure of how your brand is performing and how your market, customers, and prospects are changing. To maximize the value of a tracker, choose a well-designed solution that can answer a broad set of business questions, and consider our additional tips to take it to the next level.

This post was co-written by Lars Pahlman, Senior Director, and Robert Beatus, Head of R&D.