Blog Posts

Making good things happen on the omnichannel path to purchase

February 1, 2019

The old proverb has it that “good things come to those who wait”. According to the Internet, Abraham Lincoln added “but only what’s left by those who hustle.”

Whether Lincoln said that or not, the point remains: Waiting for shoppers to find your brand is not a winning strategy. Today, only a few brands and shopper insights leaders are beginning to fully understand the omnichannel path to purchase from the perspective of their shoppers. Those who invest in understanding shoppers’ behaviors and motivations through the omnichannel path to purchase are increasing conversion rates and growing market share by focusing investment and activity on touchpoints that matter most to shoppers. These leaders will enjoy growth, while brands that rely on outmoded constructs that separate online vs. offline, behavior vs. motivation, and paid vs. earned vs. owned, will fight over the scraps.

Early adopters across the globe are seeing the benefits of connecting the dots across dozens of online and offline touchpoints. Here are three ways Nepa is seeing shopper-centric understanding drive conversion and grow sales and market share:

1. More effective initiatives and investments, based on what matters most to shoppers

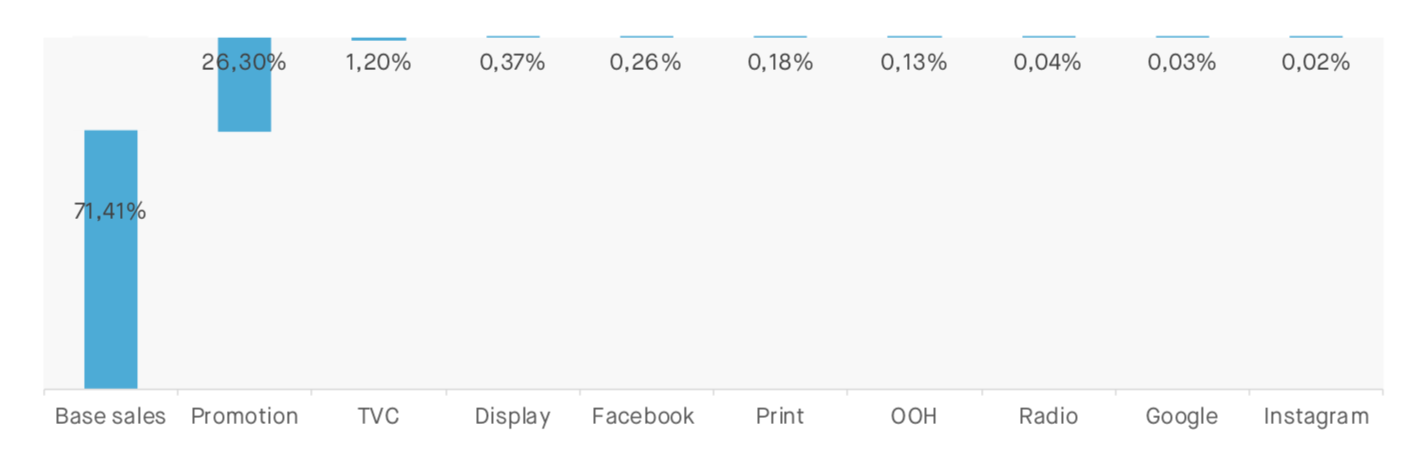

Many of the insight sources and marketing analytics techniques employed today haven’t kept up with explosion in touchpoints that can influence conversion. For example, Marketing Mix Modeling is a solid approach, but it’s typically limited to evaluating paid media with years of historical data. Similarly, multi-touch attribution modeling relies solely on online touchpoints, ignoring offline interactions. And many approaches disregard the ways in which online touchpoints influence offline sales, and vice versa, which we see across multiple categories and geographies.

In short, traditional methods don’t line up with today’s purchase paths, which might include an online product search, skimming a blog post, checking prices in store, reading a friend’s social media post, and, perhaps, a purchase on an eCommerce site. By capturing the shopper’s actual omnichannel experience, Marketers can learn the conversion power of every touchpoint, individually and in combinations, and make more effective decisions on budgets and other resources.

2. Competitive Intelligence and Inspiration

Traditional marketing analytics focus on one brand and how it’s marketed, as well as related consumer behavior. But brands and markets don’t exist in a vacuum. Omnichannel path to purchase methods recognize this obvious truth. By taking a shopper-led perspective at the category level, omnichannel sheds light on how every brand and touchpoint impact the shopper’s decisions along the path to purchase – including those of competitors. The insight gained can inspire brands to try new strategies and tactics, and to identify and neutralize their competitors’ advantages.

3. Strengthen Retail Partnerships

The path to purchase involves decisions on where to buy, as well as what to buy. Multiple retailers with similar offerings are competing for shoppers’ dollars. An omnichannel approach can help identify exactly where and why a retailer is losing category sales to a competitor. Early adopters are applying these insights to strengthen strategic retail partnerships and establish themselves as trusted category advisers. For example, Nepa recently provided a CPG client with insights and recommendations that helped its largest retail customer, Walmart, understand exactly where and why they lost purchases to Amazon. This kind of actionable intelligence leads to competitive advantage and growth.

The point is clear to early adopters of omnichannel analytics: along the path to purchase, good things happen when you hustle.