These days, many companies earmark separate budgets for long-term brand building and short-term sales activation. However, here at Nepa we have been seeing an increasing number of examples, both in our own data and other meta studies, that successful brand building creatives can drive short-term sales too.

Consumers care less about what effects a campaign is designed to have, and more that it appeals to their current needs, views and personality Too much focus on finding the right split between long and short-term benefits could therefore result in less effective campaigns and ultimately lower ROIs.

More than a decade ago, evidence that most companies are underinvesting in brand building was successfully presented by Binet and Fields in their world-famous IPA paper “The Long and Short of It”, and marketers took note. The publication suggested companies need to balance their marketing between long-term brand building communication and shorter-term activation marketing, with a suggested average split of 60/40 in favour of longer-term objectives.

What does the latest research say?

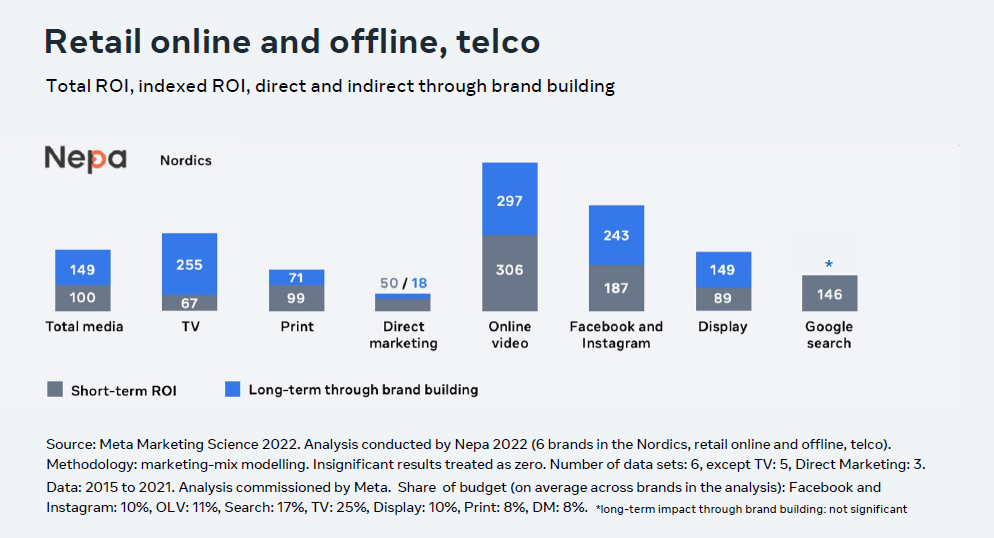

In a recent piece of cross-media research Nepa conducted in conjunction with Meta, the results demonstrated that many channels yielded effects both in the short and long-term.

As seen above, most media types can contribute to both short and long-term effects, especially online video, social media, and display. The effect of long vs short is not only connected to media type but also the creative content in each media. So, this begs the question, can the same communication build both?

We see similar indications when looking at our data on campaign creatives. It shows ads that perform strongly on brand building KPIs are not only driving long-term effects, but also short-term ones.

A typical objective for brand building communications is to evoke a positive emotional reaction among the audience that can be connected back to the brand. Hence, “ad-liking” is usually seen as an important KPI for measuring brand building effects in ads. On the other hand, “persuasive message” with a “clear call to action” are usually seen as important KPIs for sales activation.

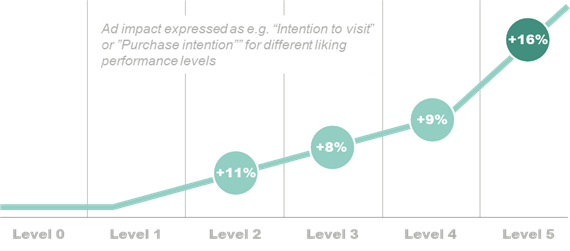

When we analysed our campaign performance database we can clearly see those campaigns with high emotional liking – the typical objective for brand building campaigns – are not only driving a positive brand perception, but they also trigger call to action effects, like purchases or website visits.

Based on more than 3,000 campaigns in Nepa’s database classified in levels 0-6 by average liking score from lowest to highest. The green curve shows the change in short-term ad impact compared to the previous level of ad liking.

Campaigns with high “ad-liking” have a significantly higher short-term impact than campaigns with a lower “ad-liking” score. The more an audience likes the creatives, the more inclined they are to act directly.

In summary, here at Nepa we have found evidence across different sources of data that successful brand building creatives can also help a company to drive short-term sales. Whilst focusing on both long-term brand building and short-term sales is important, we believe that businesses who focuses on creating the most effective messaging for their consumers will reach the perfect balance between long and short.

Written by Thomas Berthelsen and Robert Beatus, Nepa’s Heads of R&D