Path to purchase, Role of Search and Marketing Mix Modelling

Depending on what your brand is selling, the way to drive consumers’ purchase varies greatly. The approach towards a purchase is different depending on what the product is. For example people that are looking to buy a new expensive tech gadget will look into different options and research different brands, while those who are going to pick an every day item from a supermarket shelf will be influenced predominantly by the pack and the different options available in that moment.

So how can you make your brand be the final choice for people?

Path to Purchase

For lower value products like soft drinks, sweets and tinned goods there are many factors that can influence the final purchase decision. Everything consumers interact with affects what they’ll end up buying. Here at Nepa, we wanted to understand what impact each leg of the journey had on the purchasing power.

When it comes to FMCG items, consumers will often have an idea of the product they want to purchase, but not so much the brand. By understanding the path to purchase, brands are able to navigate consumers’ minds and end up in their baskets – step by step. For example, a strong brand is found early in the path to purchase and is resistant to the input from brands and their promotions, up to checkout. An even stronger brand can influence a consumer towards a purchase they would not normally make.

P2P insights are like a Rubik’s cube, every turn can create something different. Each tile represents a way we can break down the data, the demographic, the product, the brand, and the channel. With this breakdown of data, we can understand the power of each touchpoint in driving purchase conversion. We can also learn what stops a consumer in their path to purchase or what can send them in a different direction. By understanding people, we can see how much paid, owned, and earned touchpoints impact the path to purchase, and guide it accordingly.

Role of Search

Path to Purchase is great to understand how consumers are purchashing smaller goods, but when it comes to more expensive products (think cars and tech) the role of search is arguably more important. People will think long and hard on where they want to spend their money. Research, compare, and research again; we’re not just picking from a shelf.

At Nepa we collect passive data from participants, taken from their screens when researching a product. This allows us to observe the way people interact with what they see on their screens, what they click on and what they search.

Consumers tend to do two types of searches, category or branded. Category search means looking for a product with no brand preference, ‘best phones of 2022’ or ‘which car should I get’. Whereas a branded search is looking for a specific branded item ‘what Ford is the best’ or ‘difference between iPhone 12 and Pro’. By looking at consumers’ interactions we can understand what products are being noticed and which factors are more important to win the purchase.

Understanding where a consumer has searched online allows us to help brands understand where they need to be seen in order for their digital touchpoints to drive consumers down the funnel into purchase conversion.

Marketing Mix Modelling

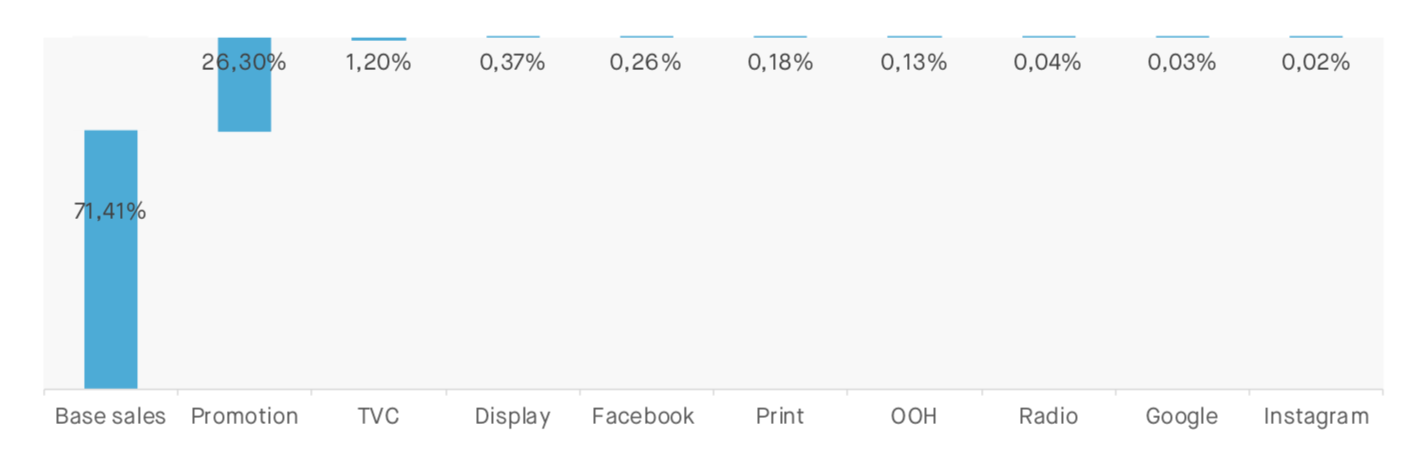

As mentioned, P2P analysis is great for holistic omnichannel insights while Role of Search is ideal for full funnel analysis of lower frequency of purchase items e.g. tech and automotive products; but when you’re want to understand where to get your best bang for buck there’s a lot more to consider. In this case brands need to optimise how they spend money on their advertising campaigns and really think about the effectiveness of each channel. To support brands in taking these decisions, we looked at several campaigns in the space of three years, and measured sales across channels. We were then able to create a model which looked at what factors have influenced the success – or not – of each channel. This can help brands understand exactly which touch points in a marketing strategy impact sales most.

The success of a campaign depends on a number of factors. For example, we look at the seasonality, the existence of external factors (COVID-19 to mention one), internal factors such as marketing and geographic distribution, and finally we analyse the media spread of the marketing. Together this economental model tells us just how much of each marketing channel can maximise the ROI. By understanding the ROI that each channel offers brands can optimise their budgets for best results.

Ultimately there are several approaches which will give different insights and help brands understand each piece of the purchase puzzle. Sometimes it might just be an MMM that’s needed. Other times it might be appropriate to overlay a P2P and an MMM. It all depends on the questions you’re trying to answer but each one can help unlock more value and drive more sales.

By Kit Sandford, Head of Analytics at Nepa UK

Want to know more? Contact us today and our brand experts will help you!