In today’s consumer-driven world brands constantly vie for attention, hoping that when it comes time to make a purchase shoppers will choose them over the rest. This relentless competition has created a complex landscape of touchpoints, both online and offline, that consumers subconsciously navigate every day. Path to Purchase research aims to decode this landscape by quantifying which touchpoints shoppers are exposed to, and influenced by, on the journey to making a purchase.

At Nepa we believe that certain ingredients are essential for effectively measuring the touchpoint landscape and consumer journeys.

1. Bring all your data points onto the same playing field

You can’t improve what you can’t track. If you’re measuring your digital, physical, paid, unpaid, owned, and earned touchpoints in different ways, with different tools, in different teams, you’re going to be making decisions based on incomplete data.

Nepa’s Path to Purchase offers a comprehensive, two-pronged approach to measure the entire touchpoint landscape. By combining behavioural web tracking with detailed survey responses over a semi-longitudinal period, our methodology captures all touchpoints in one place. This gives us a complete view of consumer journeys, enabling us to effectively measure the impact of individual touchpoints on purchase conversion across omnichannel.

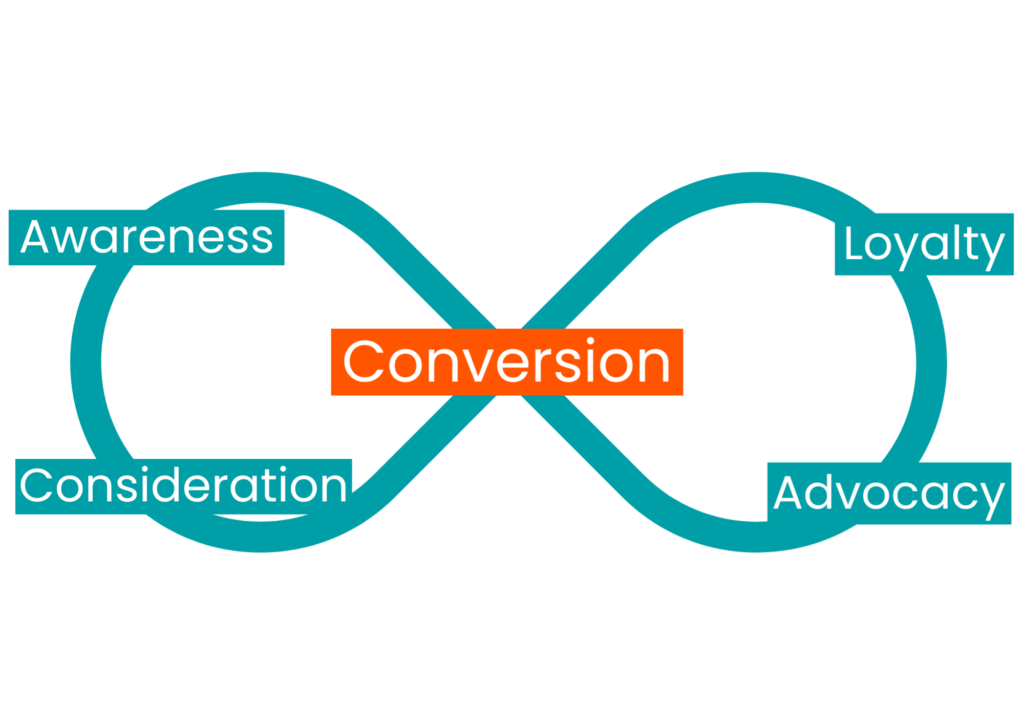

2. Focus on the one metric that truly matters: Conversion

Everything a marketer and insights professional does should be towards one goal – Driving growth. Understanding the touchpoints that have the most impact to the most people means even small teams can optimise their marketing efforts for maximum impact.

Measuring conversion is not easy: shoppers are exposed to multiple touchpoints from competing brands each time they make a purchase and, often their decisions are not made through a conscious evaluation process. However, at Nepa, we’ve developed a technique, called Conversion Power, to accurately quantify the effectiveness of touchpoints in conversion, even when purchases seem automated.

Conversion Power analysis

Nepa’s Conversion Power analysis measures touchpoint effectiveness by calculating the increased likelihood of a brand being chosen when a shopper is exposed a touchpoint of that brand prior to purchase. Conversion Power values are linked to real-life outcomes and are directly comparable. For instance, a Conversion Power of 50% means that a shopper is 50% more likely to buy Brand X if exposed to that touchpoint than if they aren’t.

Additionally, it indicates that this touchpoint is twice as effective at converting shoppers compared to a touchpoint with a Conversion Power of 25%. Our approach also determines touchpoint influence through advanced statistical modelling of observations. By doing this we avoid potential inaccuracies caused by biases in claimed respondent influence.

Measuring conversion this way empowers brands to optimize their activation strategies by defining which touchpoints to invest in based on their uplift values.

3. Collect what happens, as it happens

Memories fade, so if you’re not collecting self-stated and behavioural data at the same time, it is easy to misattribute conversions to different touchpoints. Did the shopper buy your brand because they saw it in-store, or were the paid social media posts and UGC a more important part of their journey?

At Nepa, we recognize the importance of collecting real-time data. Our Path to Purchase research methodology captures data as close to real-time as possible through a semi-longitudinal design. Capturing real time actions online is the easy part: our web tracking techniques record online touchpoint data as it occurs: each time a shopper encounters a category touchpoint, we document its type, brand, content, and timing.

Offline data collection

Capturing real-time offline (real-world) data presents a greater challenge. While it would be ideal to follow shoppers around with a clipboard and record every brand encounter, this is not feasible—at least not yet! To address this, we use a regular diary approach. Respondents receive a brief survey every 2 to 3 days, where they document their interactions with touchpoints and any purchases made since the last survey. This method helps minimize memory decay that can occur over longer periods. By combining this with the online data and collecting over a 6 to 8 week period, we can thoroughly map complex touchpoint landscape and shopper journeys, even for products with extended purchase cycles.

4. Map the entire journey

Nothing happens in a silo, so you need to understand the cross-channel effects of both online and offline marketing. Do your consumers experience a seamless experience across all platforms, or is there friction you need to improve upon to drive future growth?

This is why at Nepa we consider the ‘omnichannel’ Path to Purchase. Our solution assesses the impact of all touchpoints across both online and offline environments. We don’t just measure the effect of online touchpoints on online purchases or offline touchpoints on offline purchases. We recognize that the offline and online worlds interact, and we make sure to measure this. Given the increasing fragmentation and complexity of the omnichannel landscape, we go beyond being mere data providers. As industry leaders, we offer we act as partners and advisers to help you navigate this complex environment, empowering you to craft informed strategies and outperform the competition.

Alex Provan is a Senior Project Manager in London, who has worked on Path to Purchase research projects for high-profile brands all across the globe.